[[“value”:”

[[“value”:”

Being in the oil and gas business as a family-owned exploration and production company is one of the most significant rewards I have had in my professional career. And the number one question I get is Where are the oil prices going?

That is a huge question, and in the past, it was a lot simpler, as it involved looking at supply and demand. Now that the market is global, with geopolitical factors and various types of oil required, there are numerous variables beyond the simple supply and demand.

Like market sedament. Ten years ago, a tanker would be bombed, or captured by pirates, and there would be an 8 to 10 dollar spike in oil prices, and consumers would see that at the pumps. Now we see three Russian tankers sink, and the world continues to move along.

This week, we are seeing WTI at $59.37 and Brent at $62.25. The United States experienced significant inventory drawdowns this week, which would typically result in an upward price bump. So, another major index is thrown out the window.

Julianne Geiger from X posted this comment. “Oil prices these days are heavily influenced by general market sentiment rather than oil market fundamentals, which support higher prices.”

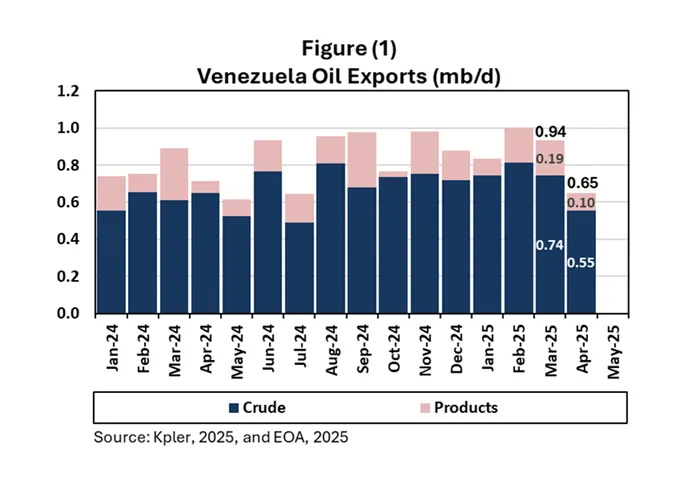

Numerous reports are emerging from OPEC and OPEC+ indicating that exports decreased by 200,000 barrels per day (bpd) in April, with half of that decline attributed to Chevron’s reduction in Venezuela.

The OPEC+ group, led by the Saudi Arabian Kingdom, requires oil to be in the $80 to $85 range to support its social programs and extensive building projects. However, countries like Iran, Russia, and a few others drill and ship more oil when they need cash flow, making it almost impossible for them to keep their production in line. If the United States needs additional cash, or China, for that matter, they just go to the Treasury and print money. The smaller countries don’t have that advantage.

In my article yesterday about President Trump putting secondary sanctions on countries that buy Iranian oil, that may hit the markets.

Iran’s oil production capacity is estimated at around 3.8 million barrels per day (bpd) for crude oil, considered its sustainable capacity that can be reached within 90 days and maintained for an extended period. Current actual production is approximately 3.2 to 3.4 million barrels per day (bpd), with 2024 expected to reach a five-year high of around 3.4 million bpd, including crude and condensate.

Historically, Iran peaked at 6.6 million bpd in 1976, but production has been constrained by sanctions, aging infrastructure, and underinvestment since the 1979 Revolution. If sanctions were lifted, Iran could potentially reach 3.8 million bpd within months, with some estimates suggesting a rise to 4 million bpd by 2023 or 5 million bpd by 2025, though this would require significant foreign investment and technology. Iran’s Oil Minister claimed in 2022 that production capacity could hit 4 million bpd, but this has not been fully substantiated due to limitations in capital and technology.

Decline rates are a challenge, with mature fields losing 8-10% annually, requiring enhanced oil recovery techniques and new well development. Without substantial investment, production could drop to 2.75 million bpd by 2028. Iran’s proven oil reserves, ranked fourth globally, stand at approximately 157.5 billion barrels, supporting long-term potential if infrastructure and geopolitical conditions improve.

The Bottom Line

There are numerous issues at play today, but we will soon know how high and how fast things can change. I do not remember things like the trade wars, Russia/Ukraine, and the realization that we need more natural gas and coal power plants all going on at the same time.

- If the Ukraine/Russia war ends, that may bring Russian oil back onto the market.

- China is showing signs of wanting to negotiate, and we may see the tariff wars end sooner rather than later.

- India appears to be moving quickly towards a trade deal, and it will likely continue to buy all the oil it can obtain.

- Iran’s oil production of 4.3 million barrels per day could be removed from the global supply.

Global demand seems to be remaining solid, and the IEA just increased its demand numbers by 200,000 bpd for the remainder of 2025.

Things look favorable for the oil and gas companies, and I feel even better knowing that we examine each well at strip pricing well below $50. We won’t stay at this mark for long, and the longer we are at this low price, the higher and longer we will be in the $80s.

That is the Crude Truth.

Source: Rey Trevino, The Crude Truth Substack

The post What is the new norm for oil prices? appeared first on Energy News Beat.

“]]