[[“value”:”

[[“value”:”

I have been saying that the Texas ERCOT system is the best setup for the projected electric demand growth in the United States. The other two of the three groups in the U.S. grid don’t seem to have as good a grip on the growth. We have been saying that there is a reason that the new data center for Stargate is being built in Abilene, and it has its dedicated natural gas power plant that will not be attached to the ERCOT grid.

Doug Sheridan is a great writer on energy, and he writes on LinkedIn today:

The FT writes, companies have abandoned almost half the projects in a $5bn Texas program to fund gas power plant construction and prevent more electricity blackouts, as they struggle with ballooning expenses and supply chain delays.

Eight projects, including those backed by Constellation Energy and ENGIE, have been cancelled or withdrawn from the state-backed scheme to beef up energy supplies in Texas. The companies blamed rising expenses, delays getting parts and uncertain revenue for their exits.

The Texas Energy Fund was established by the state to bolster the power grid after the winter of 2021 blackout. Last year, state officials unveiled 17 applications to build gas-fired power plants, which promised to deliver about 9.8 GW.

But the departure of so many developers has prompted warnings that the scheme could soon collapse. Citi analysts said in a recent note that the fund was “falling apart” and that they expected more projects to be scrapped because of “pure economics.”

The fears for the fund come as Texas’s grid operator, ERCOT, estimates peak demand would nearly double by 2030 due to an explosion in data centres, cryptocurrency mining and population growth.

Turbine manufacturers have been reluctant to invest heavily in new expansion for fear that the market could later evaporate. “The last thing we want to do is ramp up a factory, hire people, get them all trained up, and then we’ve got to lay them off,” said Rich Voorberg, president of Siemens Energy North America.

Our Take 1: You gotta love it. Texas politicians ask voters to approve a $5B taxpayer-subsidized fund to build badly needed gas-fired generation on Ercot. Voters say, okay. Eight months later, the Governor claims the fund is so vital and popular it’ll be expanded to $10B. Fast forward another ten months and… oops… the fund looks like a bust, no doubt in part because gas-fired power developers don’t believe they face good odds on Ercot. A Texas-sized circus if there ever was one.

Our Take 2: The only thing that’s going to solve this mess in the long run—on the Texas grid and in the gas-plant supply chain—is higher power rates (and possibly taxpayer bailouts).

Our Take 3: Is it really any surprise manufacturers of gas-turbines are hesitant to invest in more capacity? The US tax code and energy market mechanisms currently favor wind and solar capacity at every turn. Why would turbine manufacturers assume gas-fired developers will suddenly jump to the front of the line on grids?

Our Take 4: Why would data center developers choose a state like Texas when it seems incapable of attracting developers of the kind of 24/7 generation their businesses are going to need over the next several decades?

Doug’s article brings up some “Holy Cow Batman” thoughts as I go through his article. We know the supply chain has a massive shortage of natural gas turbines. If you don’t have a Natural Gas power plant already approved, paid for, and permitted, it will be about 4 to 5 years before you can get your turbines and connection to a grid. The supply chain will be the huge, ugly baby in the room when the Trump administration tries to meet energy demand concerns.

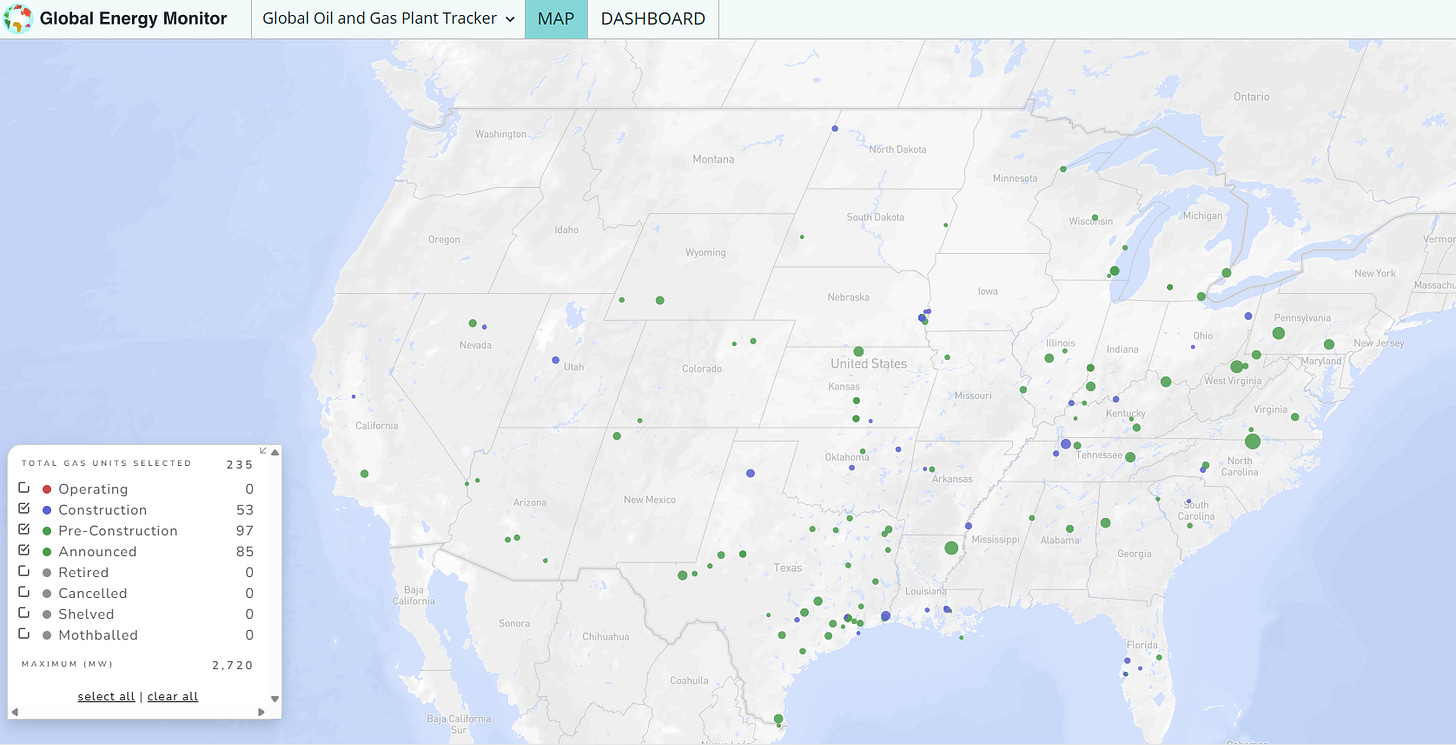

Below is the current list of natural gas power plants in the United States that are under construction, pre-construction, or announced. The ones in Blue are under construction, and most have their turbines paid for and ordered. Texas has an outstanding balance of Blue and Green plants, and much like Tennessee, West Virginia, Oklahoma, Kansas, and Indiana have balanced new and approved in process.

What stands out is the lack of planned or under-construction projects in Washington, California, New York, Iowa, Maine, New Jersey, Maryland, Vermont, and Massachusetts. This tells me that as a business analyst, I would not consider setting up manufacturing, data centers, or any business in those states.

I am concerned about these states and their plans to handle electricity growth.

Back to Doug’s article. He brings up some very valid points, that on the surface, and to the public, Texas is open for business and is a key place for economic growth. What concerns me is the total U.S. funding of electricity to the power plants of base load vs. renewable and dispatchable standby. This is a vast topic, and I will bring some guests to help break this down into bite-sized chunks.

This is such a huge issue on the components, supply chain, power plant blades, and turbines, and we know that Secretary Chris Wright has mentioned they are working to improve this issue with the other commerce leaders in the Trump Administration. It does warrant us talking about it and asking for updates regularly, as we are on a short runway.

I will keep everyone posted on the next guests about the grid, supply lines, and hopefully from the Trump administration.

Keep an eye on the new trading blocks forming worldwide, as they will be critical to the energy sector. India is ready to replace factory capacity in the short run, and we have a great view into the formation of the New Middle East.

President Trump’s trip through the Middle East is an incredible event that is unfolding newfound respect for America. The supply chain looks to be moving away from China and the EU to other Asian and Slavic countries.

Source: The Energy News Beat Substack

The post What is really going on with the Texas ERCOT grid? – Do we have a plan for success? appeared first on Energy News Beat.

“]]